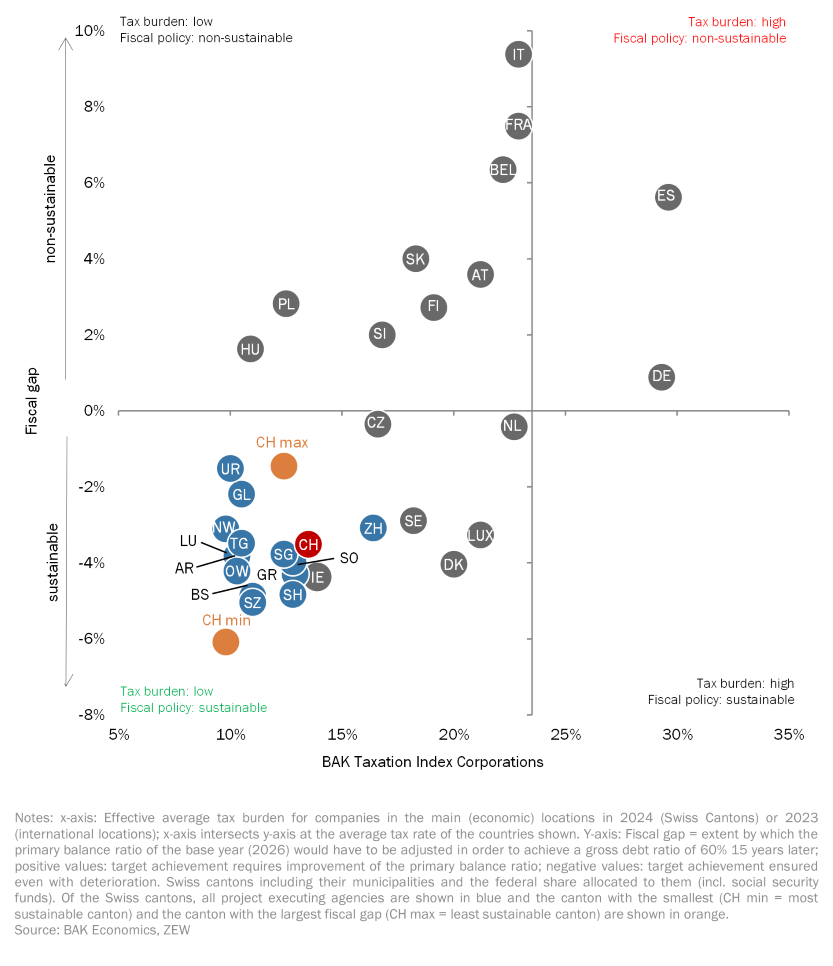

Sustainability of Fiscal Policy

The combination of the BAK Taxation Index (EATR tax burden) and the sustainability of fiscal policy provides a comprehensive picture of the tax attractiveness of a location. The sustainability of a location's fiscal policy is an indicator of the health of the public budget and thus of the durability of the current tax level: in sustainably financed locations, the tax level is secure in the longer term; in locations that are not sustainably financed, there is a threat of tax increases. The "fiscal gap" indicator is used as a sustainability criterion. This indicator shows how much a country's (or canton's) budget would have to be adjusted in order to achieve the so-called Maastricht criterion (a national debt of 60% of GDP) within a period of fifteen years.

Financial sustainability and tax burden on companies (combined view)

The Swiss cantons are characterised by a more sustainable fiscal policy than the majority of the EU countries considered. This is due in particular to the comparatively low debt ratios and the budgetary balances. At the same time, the tax burden for companies (and analogously: for highly qualified employees) is low in international comparison. Our analysis of the sustainability of public finances shows that the cantons can afford this favourable tax climate.

Methodology

The assessment of the sustainability of fiscal policy within the framework of the BAK Taxation Index is linked to an indicator from the Debt Sustainability Monitor of the EU. This is a compre-hensive monitoring of the sustainability of the fiscal policy of the EU member states, which is published periodically. The study contains a sustainability indicator "Fiscal Gap" (EU Indicator S1), to which our study links. Until the 2021 issue, the EU has used a medium-term definition of the S1 indicator. Since the 2023 edition, the "Debt Sustainability Monitor 2022", the EU now uses a long-term definition with a time horizon of almost 50 years. BAK Economics ad-heres to a medium-term view. The time horizon is set at 12 years, as in analyses from the pre-Covid period. The values of the EU countries shown were recalculated by BAK Economics for the medium-term horizon. The starting point of the fiscal gap indicator is the intertemporal budget constraint of the state. This requires that the present value of the initial debt stock and all future expenditures must be covered by the present value of the final debt stock and all future revenues. A debt ratio (government debt as a percentage of GDP) of 60% is assumed as the target debt level for all locations. This corresponds to the Maastricht criterion and ensures that the results are compa-rable between regional authorities. The influence of demographic change is taken into account in future expenditure. The fiscal gap indicator derived from the intertemporal budget constraint is defined as the dif-ference between the sustainable primary balance ratio and the primary balance ratio in the base year. (The primary balance ratio corresponds to the primary balance - i.e. the difference between primary revenue and primary expenditure - as a percentage of GDP). The sustainable primary balance ratio is the primary balance ratio that would have to be achieved each year from the base year in order to reach a gross debt ratio of 60% by the end of the period under consideration (12 years from the base year). The fiscal gap thus indicates the extent by which the primary balance ratio of the base year would have to be adjusted in order to reach the gross debt ratio of 60%. When interpreting the fiscal gap, it should be noted that negative val-ues indicate a sustainable and positive values an unsustainable fiscal policy. . The following two examples illustrate the interpretation of the fiscal gap: France's primary bal-ance ratio in the base year is -2.5%. The fiscal gap is 7.5%. This means that France needs a primary balance ratio that is 7.5 percentage points higher every year from 2026 onwards in order to meet the Maastricht criterion of a debt ratio of 60% by 2037. Conversely, the fiscal gap for the Canton of Lucerne is -3.8%, with a simultaneous primary balance ratio in the base year of 1.6%. The canton of Lucerne could therefore afford a 3.8% lower primary balance ratio every year from 2026 onwards and would still meet the Maastricht criterion by 2037. The data preparation for the cantons is designed in such a way that the individual cantons each include their municipalities and a proportion of the federal level (including social security funds) corresponding to their economic strength. The total of all cantons thus represents the whole of Switzerland.

|